The Thrift Savings Plan (TSP) for the final piece of the retirement puzzle. If you missed the articles for Social Security or Pensions, please see our blog posts that look at those topics and how they fit into the retirement puzzle.

The TSP is a retirement savings and investment plan, established by Congress in 1986, for Federal employees and members of the uniformed services. TSP offers the same savings and tax benefits that many private corporations offer their employees under 401(k) plans. It is a defined contribution plan, meaning that the retirement income you receive from your TSP account depends on how much you and your agency contribute to your account during your working years. In addition, accumulated growth of contributions will affect the TSP portion of your retirement income.

As you approach retirement after contributing to TSP during your working years, you might have one critical question—How do you know if you have enough funds in your TSP account?

DO YOU HAVE ENOUGH TO RETIRE?

While there is no magic dollar amount to determine if you have enough to retire, several factors will need to be considered. Everyone’s retirement outlook will look different depending on your retirement goals, needs, plans, lifestyle, and amount of consumer debt.

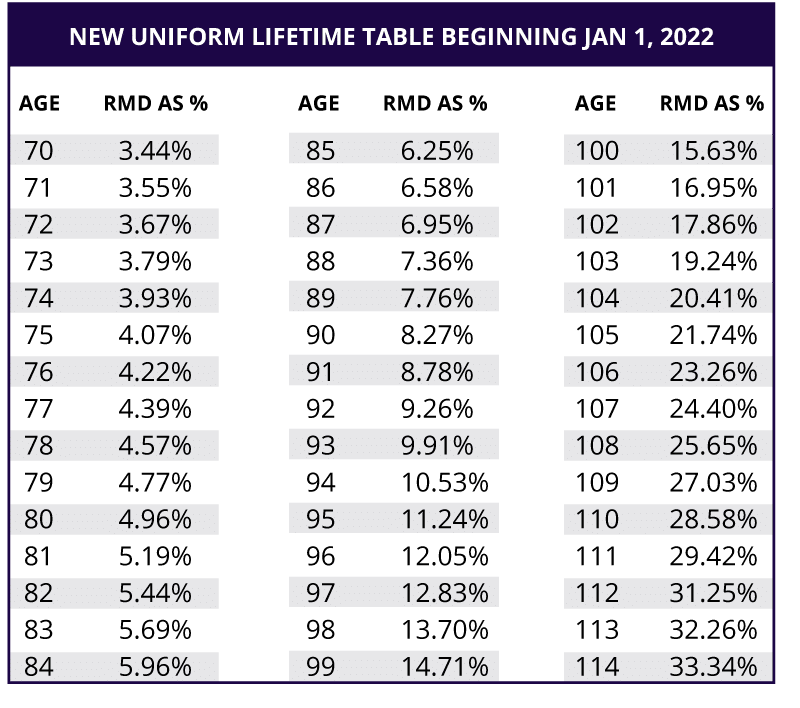

You may think that if your TSP account earns around 3% a year and you only take out 3% a year, your TSP funds could last you as long as you possibly need. However, many don’t consider that the Required Minimum Distributions (RMDs) from your TSP account will increase every year. If you continually take out percentages larger than your account earns in a year, you run the risk of not keeping pace with the withdrawal rate.

If you are curious as to what those RMDs for each year are, you can find the current Uniform Lifetime Table for Calculating Minimum Distributions on the TSP.gov website. The current RMD percentages will be changing slightly in 2022. The minimum withdrawal requirements will decrease slightly. The new RMD, as percentages, are in the chart below.

The most important way to prepare for retirement is to have a plan in place. If the TSP piece of the puzzle seems confusing, we encourage you to call us. We are happy to work with you to implement a strategy that works for your retirement goals.

HOW DOES YOUR FINANCIAL SITUATION STACK UP?

If you have any questions regarding your TSP funds and how to start planning for retirement, then it is time to take a closer look at your financial situation. Retirement may be closer than you think! Schedule an appointment today with Benchmark Financial Group by filling out the form online or calling David Raetz at 913-534-8256 to discuss your financial needs.

“Tax Information About TSP Withdrawals and Required Minimum Distributions for Beneficiary Participants” https://www.tsp.gov/. 2019.